Islamic New Year and Its Financial Wisdom

The Islamic New Year, also known as the Hijri New Year, marks the beginning of the Hijri calendar based on the migration (Hijrah) of Prophet Muhammad (Shallallahu Alaihi Wa Sallam) from Mecca to Medina. For Muslims, this moment is not merely a change of the year but a symbol of new beginnings and spiritual reflection. Beyond its spiritual significance, the Islamic New Year also offers valuable lessons in financial management. Embracing the concept of a “new year revolution,” we can use this moment to improve and plan our finances wisely, in accordance with Islamic teachings.

The Islamic New Year as a Moment of Revolution

The Islamic New Year holds profound meaning regarding change and renewal. The Hijrah of Prophet Muhammad (Shallallahu Alaihi Wa Sallam) signifies not only physical migration but also social and spiritual transformation. Similarly, we can view this moment as an opportunity for a personal revolution, including in the financial realm. Financial revolution during the Islamic New Year involves making fundamental and positive changes in how we manage wealth. This requires introspection on existing financial habits and adopting better practices aligned with Islamic values.

The Islamic New Year is an ideal time to set new financial intentions and goals. By making it a moment to revolutionize our approach to financial management, we can enhance overall financial well-being. This includes improving spending habits, saving, and investing in ways that are consistent with Sharia principles.

Practical Steps for Financial Revolution in the Islamic New Year

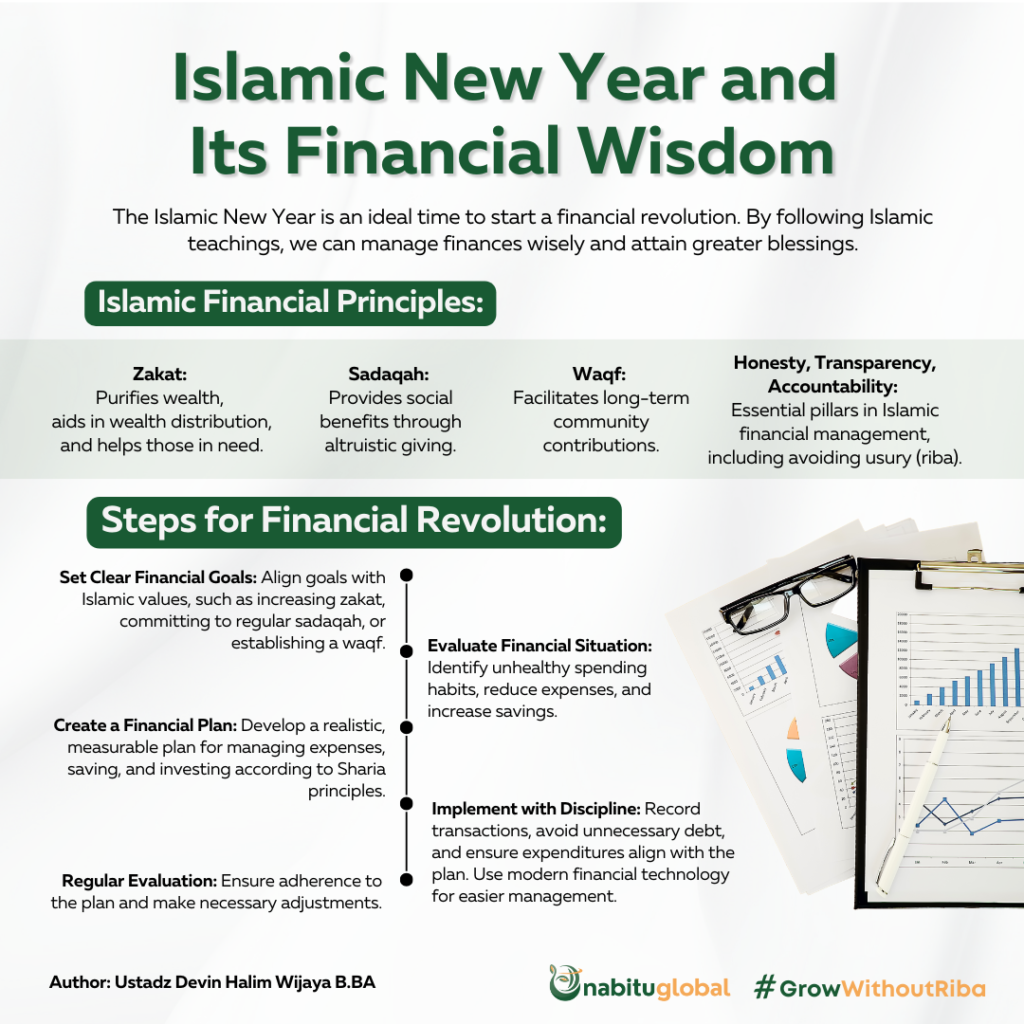

To initiate a financial revolution during the Islamic New Year, we need to start by setting clear and measurable financial goals. These goals should align with Islamic values, such as increasing zakat, committing to regular sadaqah, or establishing a waqf as part of a long-term investment. Setting these goals provides a clear direction in financial management.

The next step is a comprehensive evaluation of the current financial situation. Identify unhealthy spending habits, determine areas where we can cut expenses, and look for opportunities to increase savings. After evaluation, create a realistic and measurable financial plan. This plan should include strategies for managing expenses, saving, and investing in ways that adhere to Sharia principles.

Implementation is the key to financial revolution. Make changes with discipline, such as recording every transaction, avoiding unnecessary debt, and ensuring all expenditures align with the pre-established plan. Utilize modern financial technology to simplify record-keeping and financial analysis. Lastly, conduct regular evaluations to ensure adherence to the plan and make adjustments as necessary.

Moreover, it is crucial to involve all family members in financial planning. Effective communication can ensure that every family member contributes to and supports the shared financial goals. This also provides an opportunity to educate children about the importance of good wealth management in line with Islamic values.

The Islamic New Year is an ideal time to initiate a financial revolution. By leveraging Islamic teachings as a guide, we can manage finances more wisely and with greater blessing. From setting financial goals aligned with Islamic values to thorough evaluation and careful planning, all these efforts lead to greater well-being. Let us make the Islamic New Year a starting point to attain blessings in every aspect of life, including finances. With the right steps, this financial revolution will have a positive and sustainable impact on ourselves and the surrounding community.

References

- Ahmed, H. (2011). Product Development in Islamic Banks. Edinburgh University Press.

- Chapra, M. U. (2008). The Islamic Vision of Development in the Light of Maqasid al-Shariah. Islamic Research and Training Institute.

- Hassan, M. K., & Lewis, M. K. (2007). Handbook of Islamic Banking. Edward Elgar Publishing.

- Iqbal, Z., & Mirakhor, A. (2011). An Introduction to Islamic Finance: Theory and Practice (2nd ed.). John Wiley & Sons.

- Kahf, M. (2003). The Role of Waqf in Improving the Ummah Welfare. Proceedings of the International Seminar on Waqf as a Private Legal Body.

- Obaidullah, M. (2005). Islamic Financial Services. Islamic Economics Research Centre, King Abdulaziz University.

- Siddiqi, M. N. (2004). Riba, Bank Interest and the Rationale of Its Prohibition. Islamic Research and Training Institute.

One Comment